Cost of living

Switzerland is often perceived as expensive; however, the higher cost of living is offset by correspondingly higher salaries. Costs vary according to region and lifestyle. Switzerland offers a high quality of life.

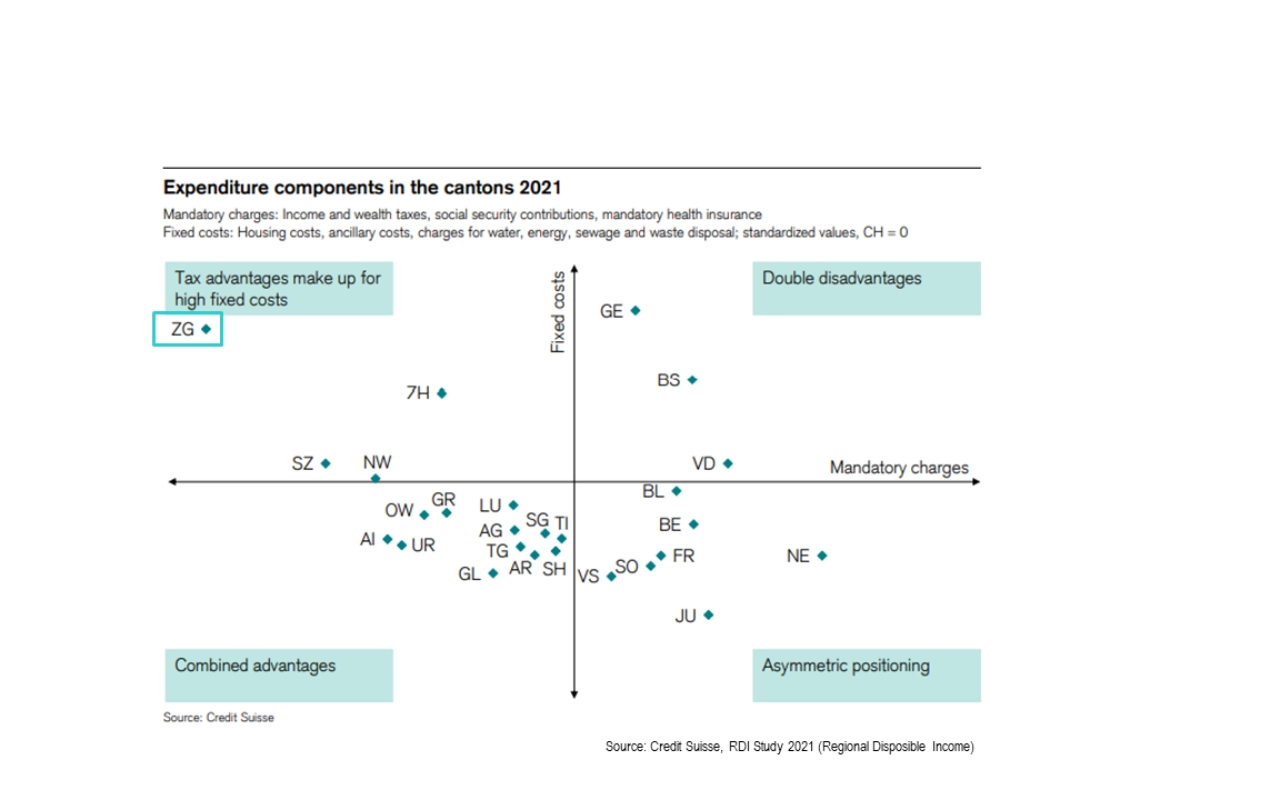

Tax benefits offset high fixed costs

Tax benefits offset high fixed costs

The expenditure components in Zug are unique; tax advantages offset high fixed costs. Geneva for example faces dual challenges with high mandatory charges. Cantons like Lucerne offer combined advantages, while others such as Basel Landschaft or Bern have asymmetric positioning.

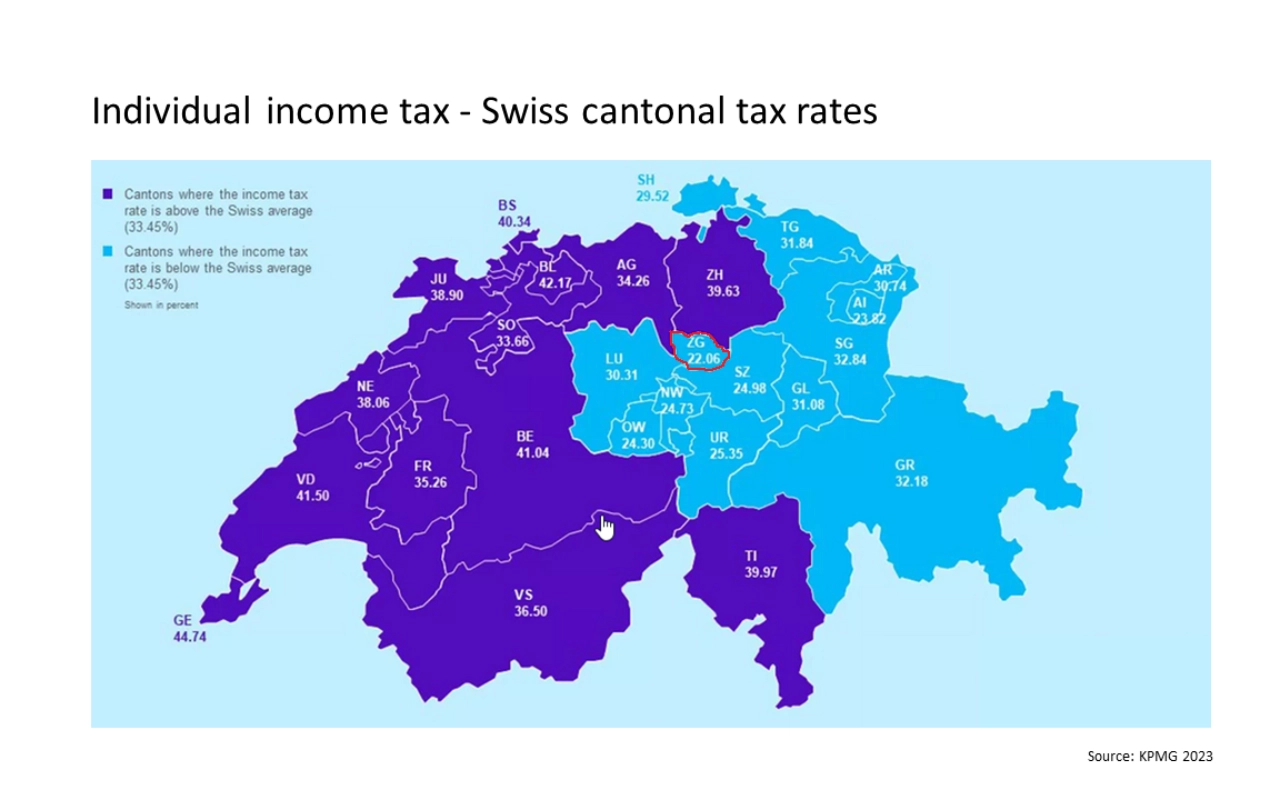

Attractive taxes for individuals

Attractive taxes for individuals

In the intercantonal tax comparison, for private individuals, a married person with two children and a gross income of 150,000 Swiss Francs finds that Zug has the lowest tax rate as a percentage of gross income among all cities, standing at 3.54%.

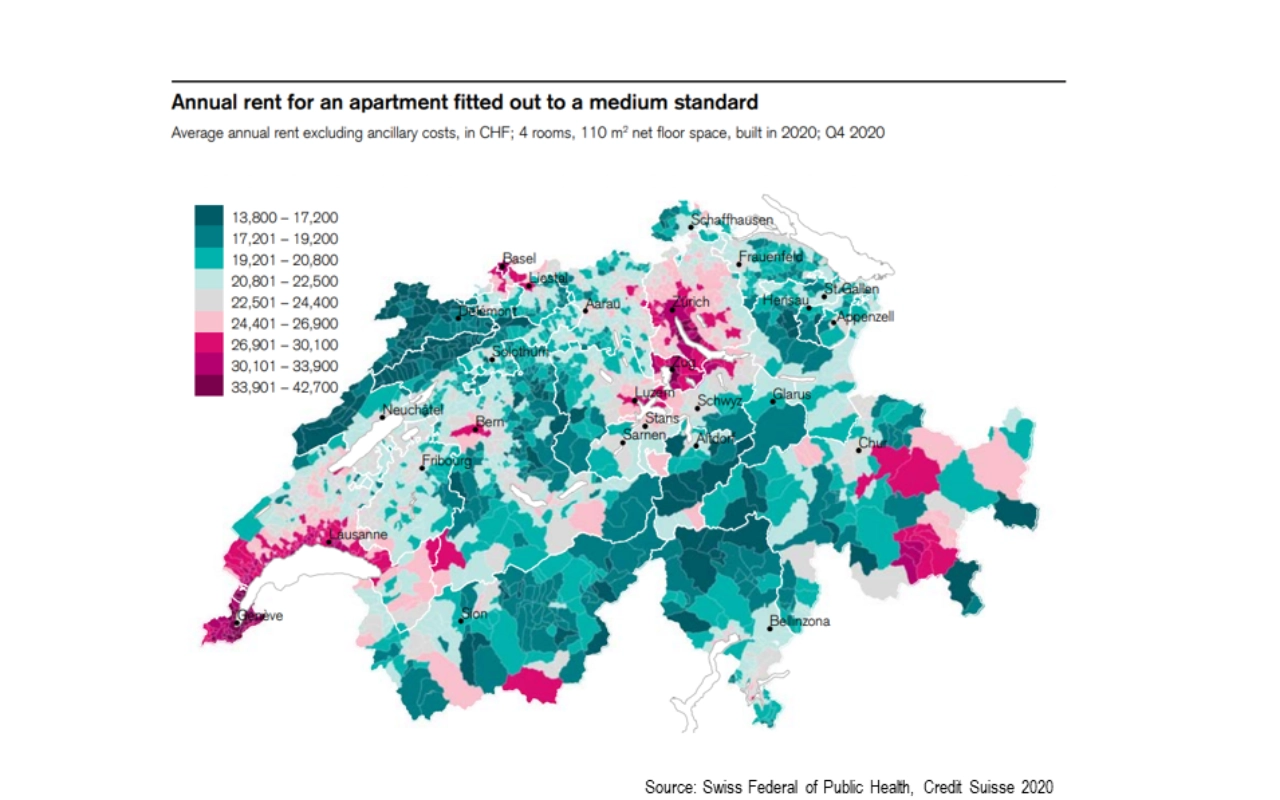

Higher housing costs in cities

Higher housing costs in cities

In major cities like Zurich, Zug, Lucerne, Basel Stadt, and Geneva, the average annual rent for a 4-room, 110m² apartment (built in 2020) ranges from 26,901 to 42,700 Swiss Francs, excluding ancillary costs. Other cantons offer significantly lower housing costs.

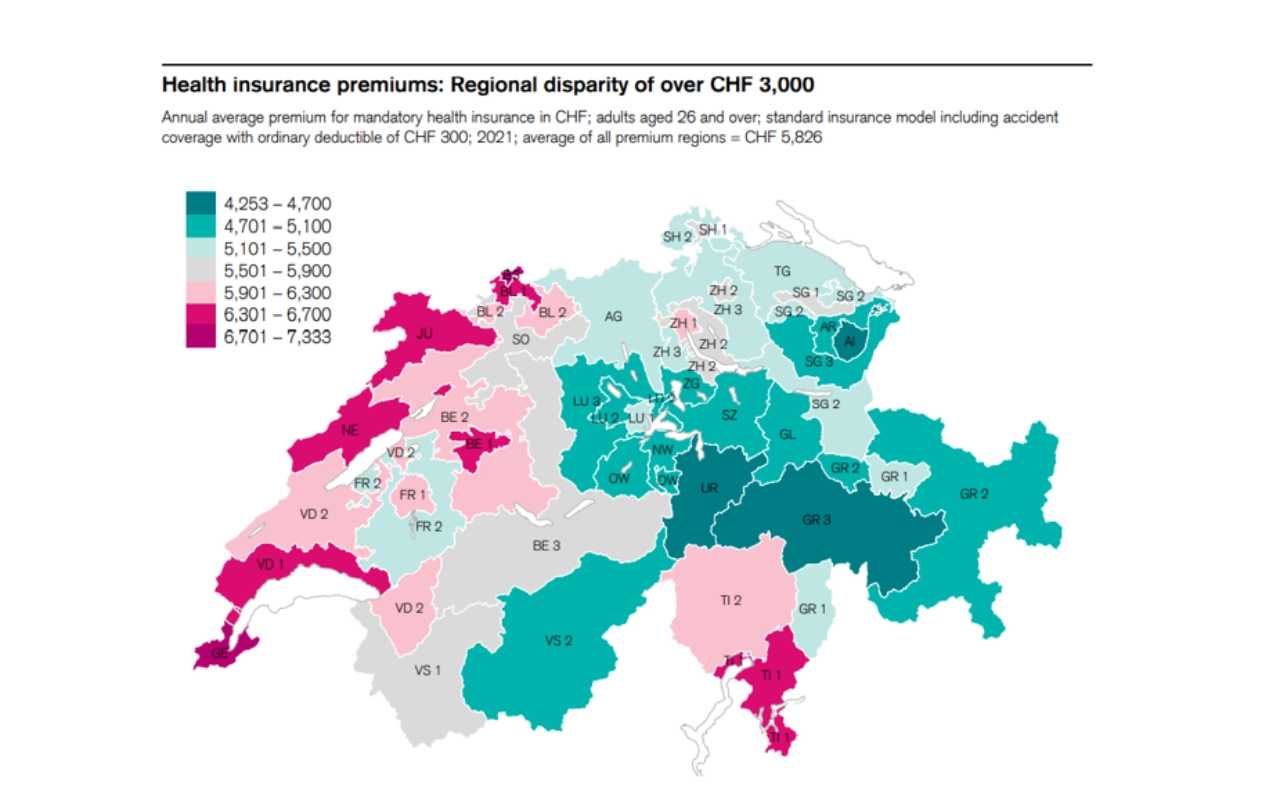

Low health insurance premiums

Low health insurance premiums

Health insurance premiums in Switzerland exhibit a regional disparity of over 3,000 Swiss Francs. The annual average premium for mandatory insurance, including accident coverage with a standard deductible of 300 Swiss Francs for adults aged 26 and over, is 5,826 Swiss Francs. Zug stands out with one of the lowest health insurance premiums.