Taxation

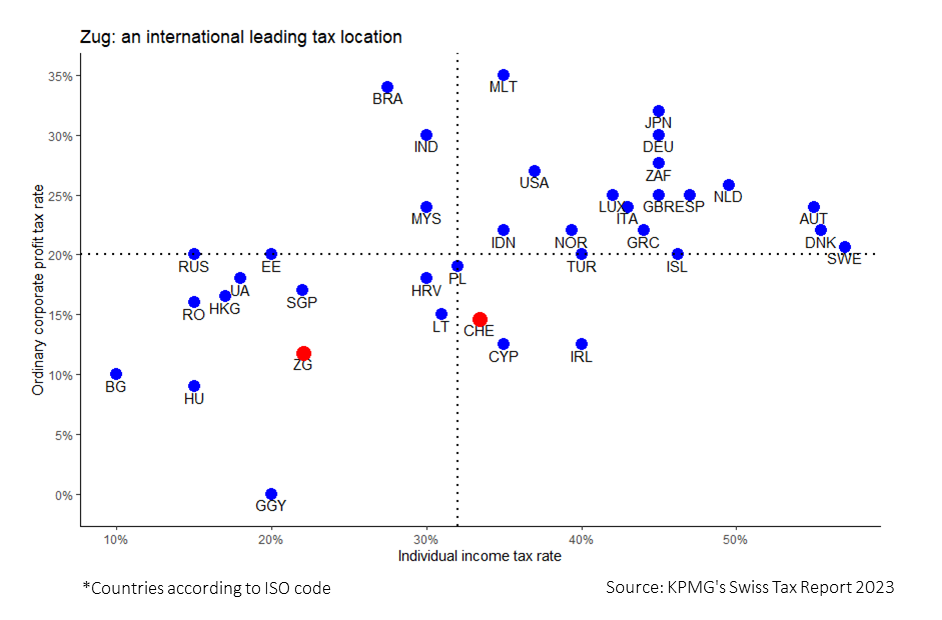

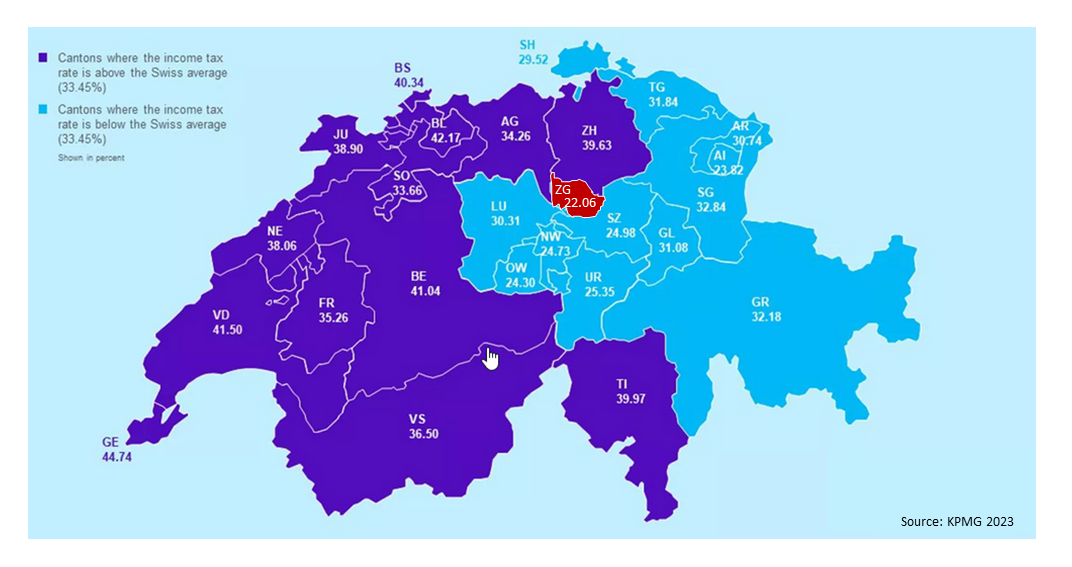

Internationally leading corporate taxation

Customer-friendly authorities

When it comes to tax matters, accessibility, customer orientation, and pragmatism are key. We pride ourselves on rapid responses and efficient processing, with a commitment to get back to you within 3 days - a benchmark we consistently meet.

Our highly experienced staff is well-versed in not only national but also complex international taxation issues. We are also actively engaged in professional circles, staying up-to-date with the latest developments in tax policy and practice.

Future OECD Corporate tax environment

In the realm of international taxation, the future OECD corporate tax environment is taking shape. In October 2021, over 140 countries, including Switzerland, agreed that large multinational enterprises with turnover of EUR 750 million or more should pay at least 15% tax on their profits. The vast majority of EU member states and other important industrialised nations intend to implement the minimum tax rate as early as 2024. However, numerous important questions remain unanswered. The specifics of implementing this minimum tax rate and its application across various industries and regions are subjects of ongoing discussion. The Canton of Zug stands as a bastion of prosperity, consistently delivering favourable financial outcomes. With the advent of OECD Pillar 2, the Canton of Zug expects a substantial increase in tax revenues. Our primary aim is to judiciously invest these additional funds, ensuring that all companies continue to enjoy a business-friendly environment.

More information about Corporate Taxation

For detailed insights on corporate taxation in Zug, turn to Chapter 5, pages 18-21 of our "Zug Doing Business" brochure. Download it here to explore how Zug fosters business growth and offers optimized corporate taxation strategies.

Contact

Steuerverwaltung <br /> Gruppe <br /> Verrechnungssteuer

Monday to Friday 08:00 - 12:00 13:30 - 17:00